11/6/2014 Volume growth in the Bankgiro system has been strong this year. Up to and including the third quarter, Bankgirot has processed almost 670 million payments to a value of SEK 6,908 billion.

The cumulative growth in the number of transactions in the Bankgiro system after the third quarter is approximately 6 per cent, which is well over the forecast for 2014. More companies are making greater use of Bankgiro numbers for invoicing, which has contributed to the strong growth in the Bankgiro system.

There are currently approximately 550,000 active banking customers in the Bankgiro system and the number of customers has increased by barely half a per cent compared with 2013. The number of transactions per banking customer, on the other hand, has increased by about 6 per cent.

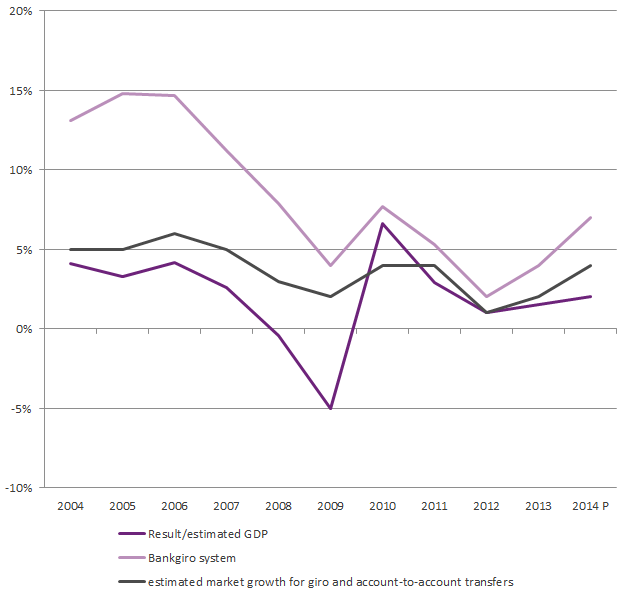

Growth in the Bankgiro system compared with growth in GDP

The diagram shows growth in the Bankgiro system compared with growth in GDP, as well as the estimated market growth for giro and account-to-account transfers.

As the diagram shows, there is a correlation between the Bankgiro system's growth and Sweden's GDP development. Since a weak general economic situation is expected to continue, this has an inhibiting effect on the volume development of the payment system.

The trend in the number of transactions in recent years has not however been as favourable as during the period 2004-2008. Those years' high rate of growth is explained by economic upturn, by the banks increasing the number of customers in the Bankgiro system and by the introduction of the so-called congestion tax in Stockholm.

The work of the banks to encourage more companies to invoice with Bankgiro numbers has been going on for several years and continues, with Bankgirot's support and cooperation. The hope is that in this way the volumes in the Bankgiro system can still be influenced positively.